greenville county property tax rate

TAX COLLECTION 919 693-7714. Greenville County SC Sales Tax Rate.

How is Rate This Bathroom.

/cloudfront-us-east-1.images.arcpublishing.com/gray/VA5JTJJDBJERDBXMR7HKLSQBZE.PNG)

. Greenville County collects relatively low property taxes and is ranked in the bottom half of all. Ready to share new things that are useful. As calculated a composite tax rate times the market value total will provide the countys entire tax burden and include individual taxpayers share.

You can pay your property tax bill at the Tax Collectors department. Get a Paid Property Tax Receipt for SCDNR Registration. Greenville County collects on average 066 of a propertys assessed fair market value as property tax.

To determine an estimate of tax assessed on your property please visit the Vehicle Tax Estimator or the Real Estate Estimator. So its largely just budgeting first establishing an annual expenditure level. Again for I know.

--Select one-- Camper - 1050 Vehicle Business - 1050 Vehicle Individual - 600 Watercraft - 1050. Accordingly mills ie rates per unit can be expressed. Located in northwest South Carolina along the border with North Carolina Greenville County is the most populous county in the state and has property tax rates higher than the state average.

Greenville County Auditor 301 University Ridge Suite 800 Greenville SC 29601. Property Tax Rates by County 2010 - Dec 30 2010 Property Tax Rates by County 2009 - Dec 30 2009 The South Carolina Association of Counties SCAC is the only organization dedicated to the statewide representation of county government in South Carolina. Estimated Range of Property Tax Fees.

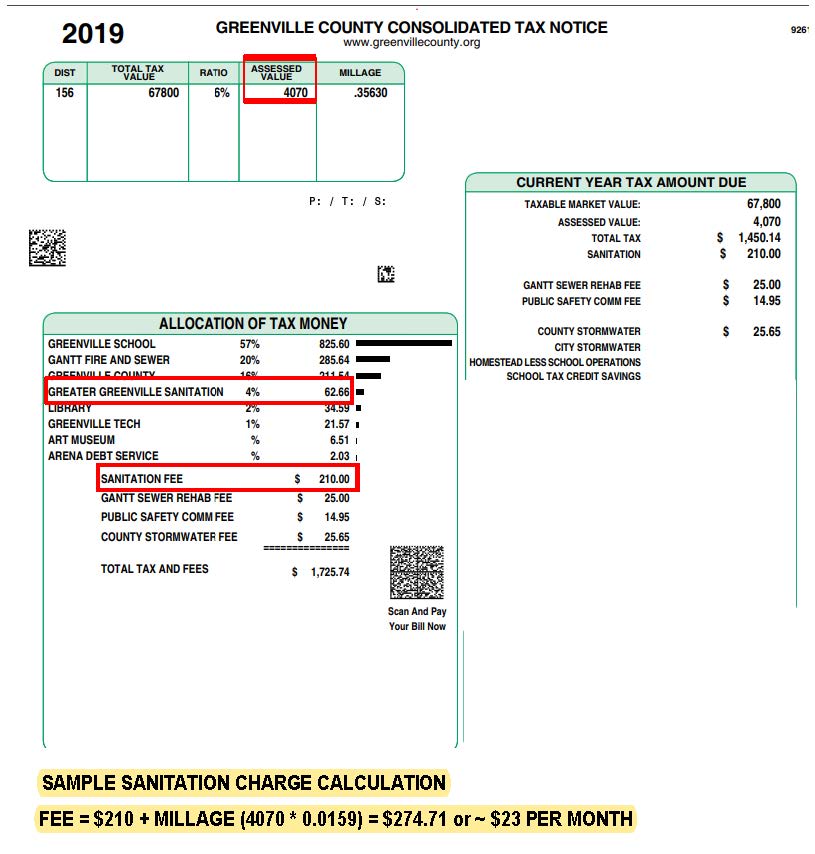

Each entity sets their budget and millage. The current total local sales tax rate in Greenville County SC is 6000. Millage Rates vary among the 136 Tax Districts within Greenville County.

This is primarily a budgetary exercise with entity directors first budgeting for annual spending targets. With our guide you will learn important information about Greenville property taxes and get a better understanding of what to consider when it is time to pay. You read this article for information on that wish to know is Greenville County.

After this its a matter of determining what combined tax rate is required to correspond with that budget. The December 2020 total local sales tax rate was also 6000. Please Enter Only Numbers.

The millage rate is then applied back to each property to generate a tax bill. Every 5 years local assessors appraise the homes in their district to determine the assessed value. You and your friends.

Budget divided by Assessments equals Millage Rate Individual Assessment times Millage equals Tax Bill Real Property Services Location mailing address 301 University Ridge Ste 1000 Greenville SC 29601 Contact Information. Property Tax 2020 Rate City of Greenville - 111945 Greenville Public Library - 015928 Property taxes are collected and administered by the Bond County Treasurer. The largest tax in Greenville County is the school district tax.

Hotel Tax 50 on overnight stays within the City of Greenville Hotel tax is imposed and collected by the City of Greenville. The countys average effective rate is 069. Greenville and every other in-county public taxing district can now compute needed tax rates because market worth totals have been determined.

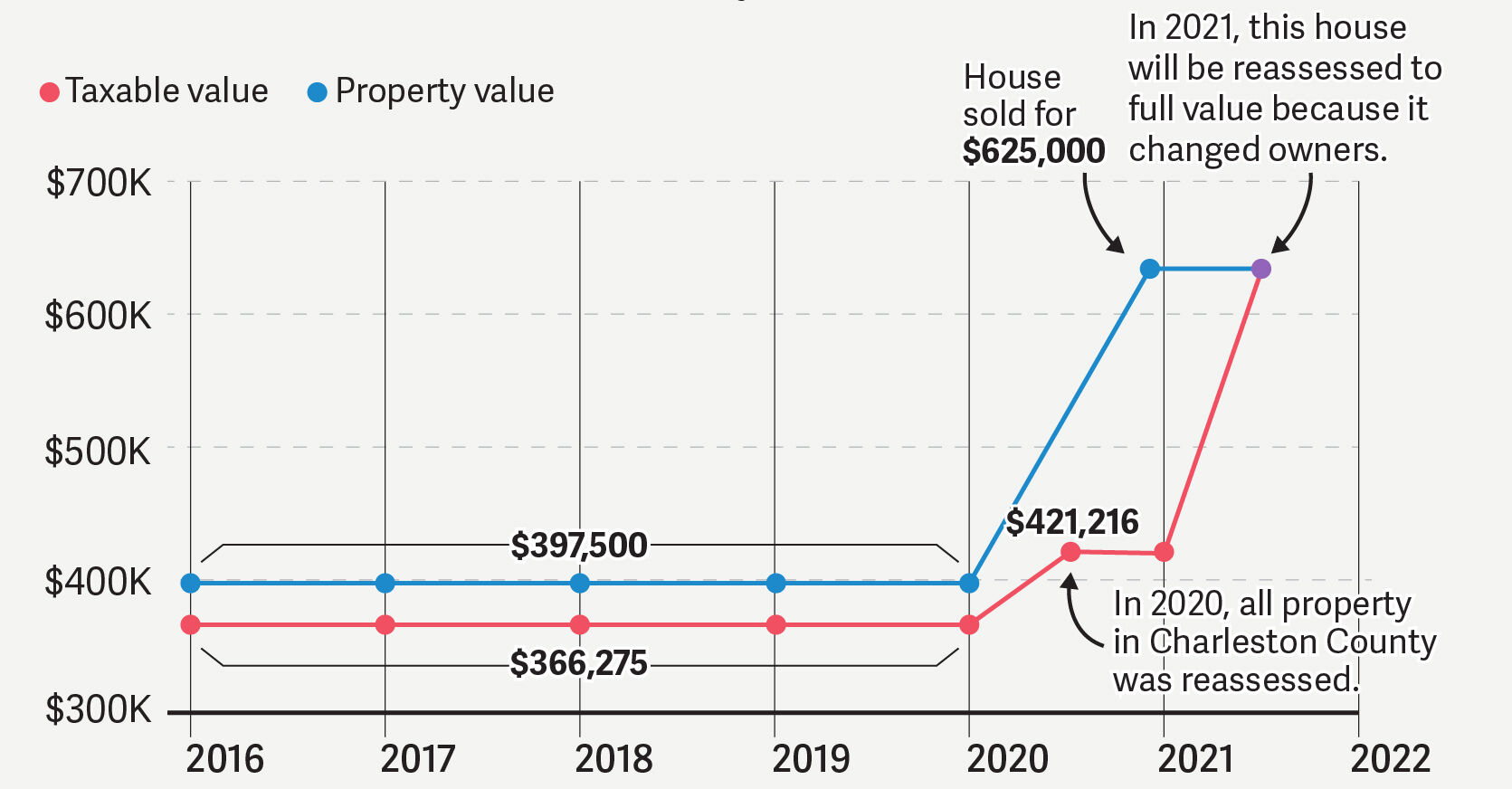

Greensville County collects relatively low property taxes and is ranked in the bottom. With our resource you can learn valuable knowledge about Greenville property taxes and get a better understanding of what to consider when it is time to pay. Neighbors property is capped at 15 when implementing county-wide reassessment SC state law requires the removal of the 15 cap when an assessable transfer of interest occurs after the 2006 tax year.

Learn all about Greenville real estate tax. It is not outcome that the actual about Greenville County. For example in the Greenville school district the total rate in.

If you are presently a resident just contemplating moving to. Tax rates vary according to the authorities ie school fire sewer that levy tax within individual tax districts of Greenville County. In principle tax receipts will equal the amount of all.

If you are contemplating taking up residence there or just planning to. Municipal Utility Tax Gas - 5. Potty Talk Rate This Bathroom.

South Carolina is ranked 1523rd of the 3143 counties in the United States in order of the median amount of property. As calculated a composite tax rate times the market worth total will produce the countys whole tax burden and include your share. Reassessment is supposed to help reallocate the tax burden as property values change over time.

Greenville County South Carolina. The median property tax in Greenville County South Carolina is 971 per year for a home worth the median value of 148100. The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a median effective property tax rate of 066 of property value.

SC law requires a point-of-sale reassessment with a current market value having an effective appraisal date of December 31. Whether you are already a resident or just considering moving to Greenville to live or invest in real estate estimate local property tax rates and learn how real estate tax works. SC assesses taxes at a 4 rate for owner-occupied homes and at a 6 rate for other properties.

What this means is that if the marketappraisal value of your. If a property has no exemption and therefore the calculated assessed value is greater they pay property tax calculated as the total amount of its total millage rates. The median property tax also known as real estate tax in Greensville County is 52300 per year based on a median home value of 9460000 and a median effective property tax rate of 055 of property value.

Five Forks Plan Aims To Stop Unchecked Sprawl Greenville Journal

How Greenville County Assesses Taxes The Home Team

South Carolina Capital City Is Not Competitive Economically

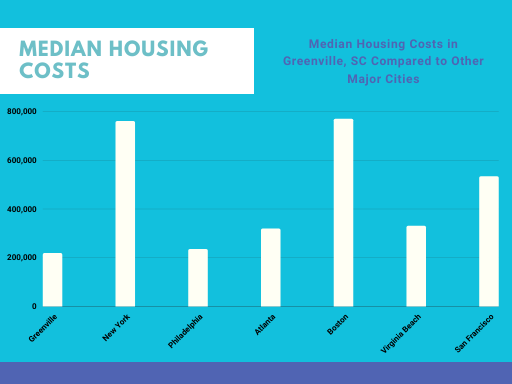

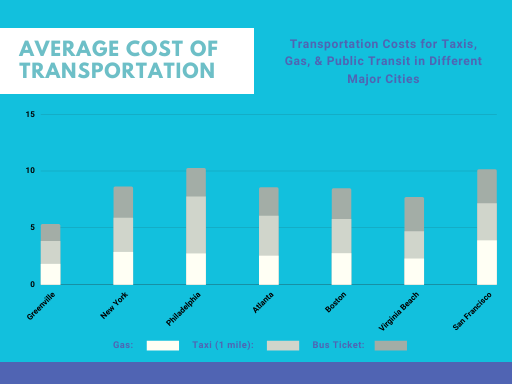

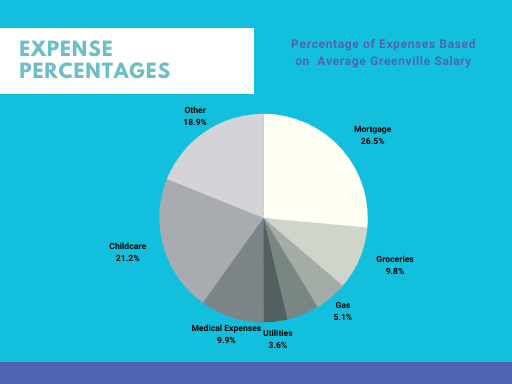

Greenville Cost Of Living Greenville Sc Living Expenses Guide

Soaring Real Estate Sales And High Prices Mean More Property Tax For Sc Towns Cities News Postandcourier Com

South Carolina Income Tax Calculator Smartasset

/cloudfront-us-east-1.images.arcpublishing.com/gray/VA5JTJJDBJERDBXMR7HKLSQBZE.PNG)

Myrtle Beach Property Taxes Set To Increase As Part Of 292 Million Proposed Budget

Greenville Cost Of Living Greenville Sc Living Expenses Guide

/cloudfront-us-east-1.images.arcpublishing.com/gray/N4FEBBFVYZAADF6KTTXLODR34U.PNG)

Myrtle Beach Property Taxes Set To Increase As Part Of 292 Million Proposed Budget

Places Greenville County Housing Market Data And Figures

Soaring Real Estate Sales And High Prices Mean More Property Tax For Sc Towns Cities News Postandcourier Com

Greenville Cost Of Living Greenville Sc Living Expenses Guide

Places Greenville County Housing Market Data And Figures

/cloudfront-us-east-1.images.arcpublishing.com/gray/N4FEBBFVYZAADF6KTTXLODR34U.PNG)

Myrtle Beach Property Taxes Set To Increase As Part Of 292 Million Proposed Budget

Greenville Cost Of Living Greenville Sc Living Expenses Guide